Walter Noel Was A Double Dipper.

He Got High Fees From Fairfied Greenwich Investors

And Big Payouts From Bernie Madoff

NEW SURGEON GENERAL'S WARNING:

Any overconfidence in your ability, willingness and need to take risk may be hazardous to your health and wealth.

==================================================

Fairfield Greenwich's $14.1 billion in assets under management, a full $7.5 billion was in assets controlled by Madoff!

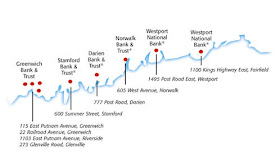

From the Fairfield Greewich website.

Very little surprises me in the Greenwich Hedge Fund world, but I find myself almost perplexed by the fact that a hedge fund's supposedly sophisticated investors would allow Greenwich resident Walter Noel to basically act as an ultra-high-fee middleman.

Fairfield Greenwich didn't even manage more than half of the assets for which they were charging these high fees, but merely passed them along to Madoff who rewarded Walter Noel with up to 300 Million a year.

On Jan. 4, 2006, the SEC's enforcement staff in New York opened an investigation, based on Mr. Markopolos's allegations, into whether Mr. Madoff was, in fact, running a Ponzi scheme. The SEC staff received documents from Mr. Madoff and Fairfield Greenwich, a hedge fund that placed money with Mr. Madoff on behalf of its clients. The SEC also interviewed Mr. Madoff, his assistant, an official from Fairfield Greenwich and another employee.

The staff recommended closing the investigation because Mr. Madoff agreed to register his investment-advisory business and Fairfield agreed to disclose information about Mr. Madoff to investors. The SEC report said the staff closed the case "because those violations were not so serious as to warrant an enforcement action."

Predictably, the Madoff story has prompted speculation about potential new regulations that might be imposed to head off future problems. Politicians and pundits have called for the adoption of new rules for securities markets in general and hedge funds in particular, even though Mr. Madoff didn't run a hedge fund and there is no shortage of existing securities rules that were violated by his reported conduct. (Keeping two sets of books suggests his own recognition of that.)

The SEC's failure to pursue complaints about Mr. Madoff over the past decade wasn't the result of inadequate regulations but of disbelief that someone so well entrenched in the industry -- a former Nasdaq chairman and SEC adviser -- was capable of committing such a callous crime

Since 2000 and especially after the fall of Enron, the SEC's annual budget has ballooned to more than $900 million from $377 million. Its full-time examination and enforcement staff has increased by more than a third, or nearly 500 people. The percentage of full-time staff devoted to enforcement -- 33.5% -- appears to be a modern record, and it is certainly the SEC's highest tooth-to-tail ratio since the 1980s. The press corps and Congress both were making stars of enforcers like Eliot Spitzer, so the SEC's watchdogs had every incentive to ferret out fraud.

Yet they still failed to nail Bernard Madoff.

The fact is that the only people who seem to have taken concrete action to protect investors from Mr. Madoff are private research shops like Aksia LLC. Its analysts did the real work of figuring out that Mr. Madoff's claimed investment strategy couldn't be happening at the volumes he claimed to be trading. Likewise, it was the short sellers who first blew the whistle on Enron, while the SEC was clueless and the firm's auditors were asleep.

Scared Hedge Fund managersare now saying instead of shoveling more money and power to the regulators who already had plenty of both, let's take care not to overregulate the people who actually warned about Mr. Madoff's miracle returns.

These same Hedge Fund managers say law enforcement is useful in punishing wrongdoers after the fact, which will deter some crooks. But expecting the SEC to prevent a determined and crafty con man from separating investors from their money is no more sensible than putting your life savings with a Bernard Madoff.

But these Hedge Fund Managers are soon going to learn that the Wild Wild West Days are over and their days of unregulated trading is coming to a quick end. These modern day robber barons are going to start learning what the words "ethical behaviour" mean

Moreover, they days of a greedy Hedge Fund Manager being taxed at a 15% rate, while his secretary is taxed at a 35% rate are also numbered.

MORE ON WALTER NOEL:

The Noel family made tons of money and become filthy rich running Fairfield Greenwhich Group.

Some Fairfield Greenwich investors are trying to get money from the SIPC insurance (up to $500k). However, attorneys and the SIPC acknowledge that it can take a long time to sort out the mess and only then can investors possibly get some money back.

Apparently, Fairfield Greenwich acted simply as a middleman between investors and Madoff, and charged hefty fees for doing so. One wonders if WalterNoel will possibly face having to pay back 10-20 years worth of fees.

The NY Times article linked above references an LA-area advisor named Gerald Breslauer who has collected millions in fees over the years for sending checks to Madoff.

How much effort would it have taken Noel of Breslauer to determine that there may be something fishy going on? It is easy to say this in hindsight, and without having had any assets involved, but one would have to think that a hedge fund manager like Noel would need to see more than a glossy sheet showing 20 years of excellent returns to convince him to invest Billions with somebody.

Just what part of Walter Noel's 1.5% fee and 20% of the profits went to doing due diligence?

Walter Noel and his family members were experts at bullsh*ting clients on the golf course, country-clubs and figuring out what to order at the 4-star restaurants.

What's even scarier to long term Greenwich Fairfield Investors and Walter Noel's family members is that, because this Ponzi scheme the government may be able to "claw back" some of this money.

Imagine how it would feel to be a Fairfield Greenwich / Madoof victim and then learn that, not only have your current assets vanished, but you have to give back previous earnings on money you no longer have.

===============================================================

Please send your comments to GreenwichRoundup@gmail.com or click on the comments link at the end of this post.